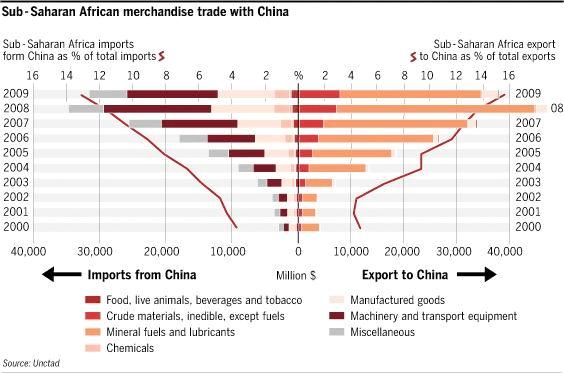

In the debate over strengthening ties between China and Africa, trade relations are often boiled down to China’s insatiable hunger for African oil and minerals. China’s friends say this is a gross oversimplification, but the latest chart of the week (after the break) shows it’s not unreasonable. Exports from sub-Saharan Africa to China lack diversity: 89 per cent last year were oil, minerals and other raw materials. The value of exports has grown at a staggering rate over the past decade - from $4.2bn in 2000 to $38bn in 2009 - but the high proportion of primary goods has not changed. Two things, however, get less recognition: the high concentration of exports from just a few African countries, and the nature of the trade in the opposite direction.

Overall, commerce between China and sub-Saharan Africa last year was $69.6bn, down from $82bn in 2008 due to the effects of the global economic downturn. It is already bouncing back this year. The value of sub-Saharan Africa’s imports from China tends to be lower than the value of its exports to China, but not always and not by much: over the past decade imports were worth between 65 per cent and 105 per cent of the value of exports. One key part of what’s heading to Africa from China is manufactured goods. The low prices of many Chinese consumer goods mean they fit neatly with African demands and help broaden the range of products African consumers can buy: particularly footwear, furniture, lighting, textiles, electronic toys and pharmaceuticals. The countries with the largest proportion of imports coming from China are the tiny economies of Togo, Botswana and Lesotho, which are buying mainly fabrics and clothing. But more African money is spent on machinery and transport equipment. As the African Development Bank noted in a paper in July, that is “linked to the strong presence of Chinese firms in the infrastructure sector, specifically in telecommunications, road construction and [the] construction of numerous public buildings”. Many of those Chinese companies have won building contracts linked to concessional financing from state-owned Chinese financial institutions. In absolute terms South Africa is the biggest importer from China, bringing in telecoms equipment, computers and other goods that accounted for 26 per cent of all sub-Saharan imports last year. Of the biggest economies, South Africa also has the most balanced trade relationship with the Asian superpower: its exports of ores and precious metals helped it to contribute 15 per cent of all sub-Saharan exports to China last year. The largest exporter is Angola and the majority of its shipments are oil. The same is true for Sudan, the second biggest exporter, which sends over 60 per cent of its exports to China, making it one of the most reliant on the Asian country. In both Sudan and Angola, Chinese state-owned companies have played a crucial role in developing the energy sector since the 1990s. The list of top exporters is completed by the Democratic Republic of Congo, the Republic of Congo, and Equatorial Guinea - and those six alone account for a remarkable 86 per cent of sub-Saharan exports to China. Outside that group shipments fall off sharply, demonstrating how China’s mineral grab is concentrated in just a few places and is not yet a pan-continental trend. In spite of the high proportion of oil and minerals in the export figures, the share declined marginally as Africa’s manufactured exports rose to 8 per cent of the total last year, up from about half of that proportion at the start of the decade. But most manufacturing is still about making products derived from raw materials such as copper, iron, silver and aluminium. Many African governments would like produce higher-value products - and to encourage that China is investing more in African industrial parks and special economic zones. However, one senior US official has described China in Africa as “a pernicious economic competitor with no morals”, according to a WikiLeaks cable. If that is accurate, the China-Africa trade balance is unlikely to shift.